Three of these conversations in the last week all started with the same line; “I wish someone had told me to start paying into a pension earlier in life”. Bearing in mind one of these conversations was with a financial planner, we thought we would write a quick blog on the importance of saving early.

For Everyone

The core reason for paying into a pension, or indeed any savings plan, early on in life is due to compounding interest, that is, interest being paid on interest received so that over time you are making money on more than just what you have contributed.

Over the shorter term, this does still have an effect, but over a longer period, it starts to make a significant difference.

If we imagine an individual decides that they want to retire at age 60, they will invest a total of £240,000 in a savings plan (could be a pension) over their lifetime towards this goal. The graph below shows the difference paying in £500pm from age 20, £666.67 per month from age 30, £1,000 from age 40, or £2,000 per month from age 60.

We have assumed a constant 6% pa growth and the differences in the values at age 60 are huge. The plan that started at age 20 is now worth £990k, over four times the total invested. Compare this against starting to save at age 40 and the plan is not even worth twice the total invested amount.

This is without even touching on the fact that if these contributions were to be invested into a pension then they would receive tax reliefs up front as well as the ability for the monies to grow free from Capital Gains Tax.

This is all easier said than done, someone in their 20s or 30s is likely to have other priorities such as saving up to purchase a house or the expense that comes with starting a family but being able to set aside even a small amount each month can make a significant difference. In 2012, Auto-Enrolment was introduced in the UK and most workers over the age of 22 in the UK are now automatically enrolled into their employer’s pension scheme. This means that at least a small portion of their wages unless they have opted out, will be getting saved.

One area this misses though is those who decide to be self-employed. According to the ONS, there is roughly 13% of the working population who are self-employed. These people do not have the benefit of being automatically enrolled into a workplace pension scheme and have the added challenge of balancing investing in their business now or extracting funds to save for later in life.

This brings us nicely to business owners and their challenges, but also opportunities.

Business Owners

Often what we find is that business owners tend to neglect saving money for retirement and instead focus on their business being their main asset. They reinvest monies back into the business to grow this over time with the plan to sell the business and sail off into the sunset.

Instead, we believe that extracting wealth through the business journey can have significant benefits. One of the key benefits is that if you can extract enough wealth through your lifetime to be able to afford the retirement you desire, a business sale suddenly becomes less pressurised. This can mean that both the timing of the sale, and the amount you require from that sale can become less of a focus as you start to look towards retirement.

There are also various other benefits for business owners. Firstly, there are significant tax benefits, both personally and for the company to make pension contributions out of the business. The capital in the pension can now also grow free of capital gains tax.

Finally, it is a great diversification tool. If all profits are being reinvested into your business, then you are essentially investing all your eggs in one basket. Albeit, you have a greater level of control over said basket, there is still the risk that if things go wrong in the business, your full life’s work could end up being lost.

Remember, whilst for most people a regular savings plan is easier, a lump sum every few years, where the business has had a successful year, is still of huge benefit in the long run, and as before, the earlier this is started, the better.

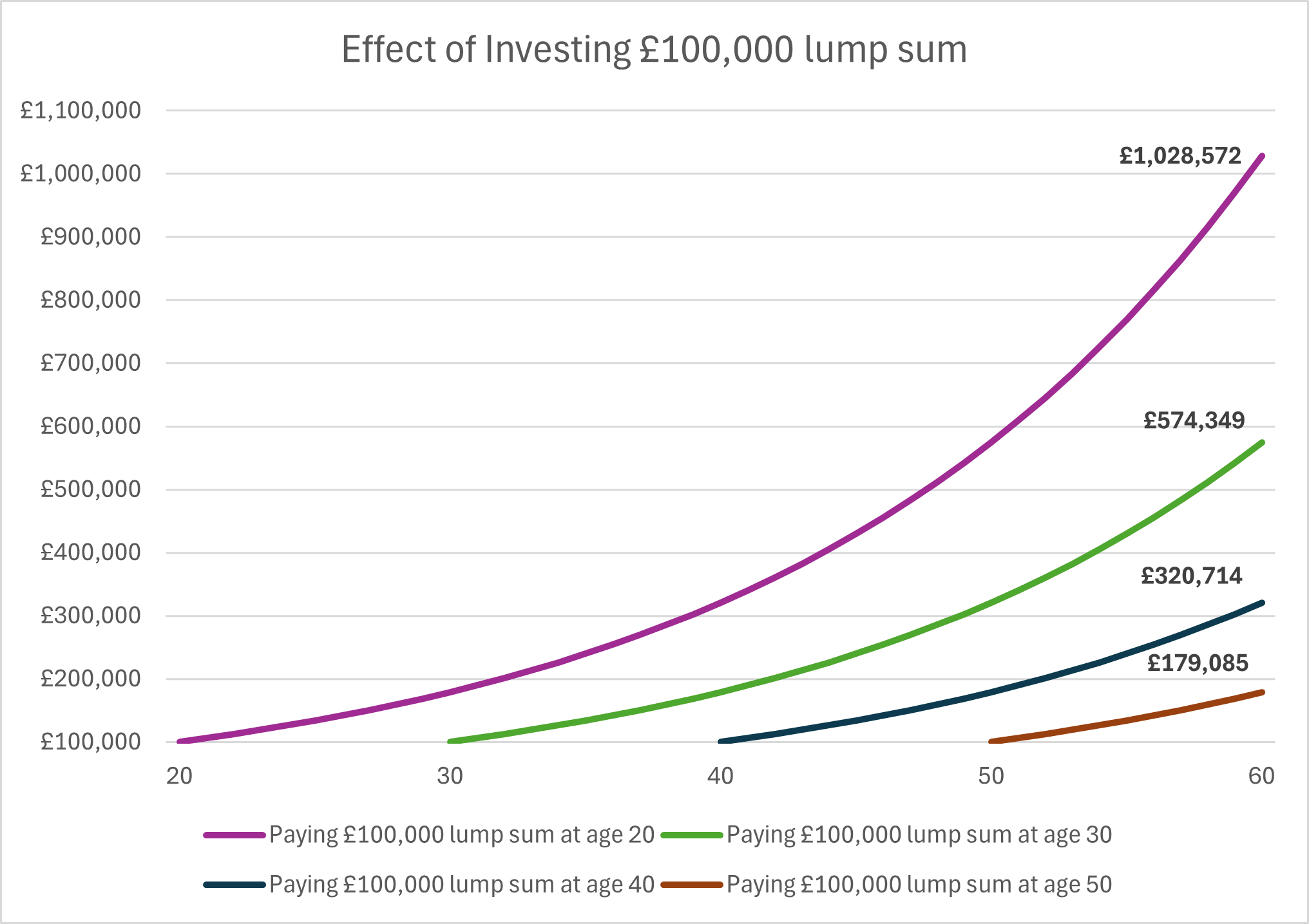

See below the graph which demonstrates the effect of extracting £100,000 in a single lump sum at various ages. You will see a lump sum extracted at age 20 and growing at 6% per annum for 40 years returns of 10x the initial capital compared to the same lump sum being invested for 10 years, not even having time to double in value. Please note, it might not be possible to pay £100,000 into a pension in a single tax year so please seek advice before taking any action.

Summary

For anyone thinking of starting to save into a pension but has hesitations, don’t put it off forever. The earlier you start, the better, and your future self will thank you for it. If times get tough and you have to stop your savings, this is ok and you can rest in the knowledge that what you have saved up to this point will be invested for longer than if you had never started. It is worth noting that according to the FCA, the average pension pot for those aged 55-64 is £137,800. Saving just £60 per month from age 20 to 40, receiving tax relief at source, and growing at 6% per annum would result in a larger pension pot than the current UK average.

Please feel free to share this with anyone you think may find this useful. None of the above should be treated as advice.

Footnotes

None of the above should be treated as advice.